ST Engineering Delivers Record Revenue and Net Profit in 2024

- Order book was $28.5b as at end December 2024, of which about $8.8b is expected to be delivered in 2025

- Commercial sales [1] and defence sales [1] constituted $7.8b and $3.5b respectively in 2024

- Cash and cash equivalents of $430m as at end December 2024

- N.B. All currencies are in Singapore dollars

ST Engineering FY2024 Financial Statements, ST Engineering Results Presentation FY2024

Singapore, 27 February 2025 - Singapore Technologies Engineering Ltd (ST Engineering) today reported its full-year (FY) financial results ended 31 December 2024.

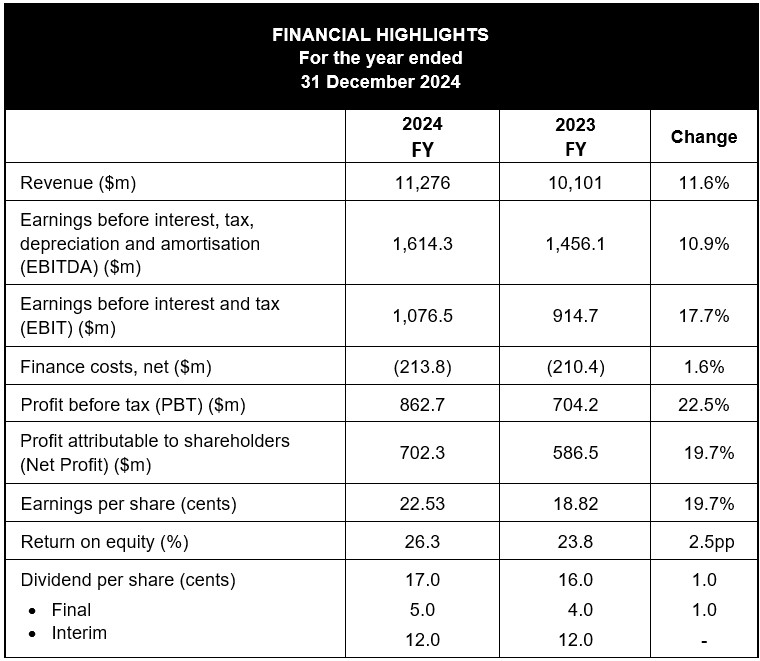

The Group ended the year with a revenue of $11.28b, reflecting a 12% year-on-year (y-o-y) increase from $10.1b, contributed by all three segments. Group EBIT reached a new high of $1.08b as it rose 18% y-o-y from $915m. Group PBT was $863m, 23% higher y-o-y from $704m while Group Net Profit grew 20% to $702m from $586m last year.

At the segment level, Commercial Aerospace posted a revenue of $4.38b, up 12% from $3.91b the year before. Excluding aircraft sales, revenue from this segment would have been 15% higher y-o-y. Segment EBIT rose 19% y-o-y to $400m from $337m. The improved performance was contributed by higher sales from Engine MRO, nacelles, composite panels and freighter conversions (PTF). Its PTF business recorded $706m in revenue, surpassing its 2021 Investor Day revenue target of $700m set for 2026. Additionally, this business achieved a mid-single digit EBIT margin percentage as expected.

The Defence & Public Security segment posted a revenue of $4.94b, 16% higher than $4.25b in the year before. Its EBIT was $636m, 12% higher compared to $567m a year ago. The improved EBIT performance was driven by contributions from Digital Systems & Cyber, Land Systems and Defence Aerospace. Excluding the U.S. Marine’s post-sale completion gain of $16m in the prior year, its EBIT would have been up by 15%. The Digital business comprising Cloud, AI Analytics and Cyber businesses grew 39% y-o-y to $645m from $463m, exceeding its 2021 Investor Day revenue target of $500m set for 2026.

In line with the Group’s prior guidance, the Urban Solutions & Satcom segment achieved improved results compared to the same period a year ago. The segment posted $1.96b in revenue, and its EBIT improved y-o-y to $40m contributed by Urban Solutions and the absence of Satcom’s divestment loss and lower severance costs. Its Satcom business showed early signs of improvement as its transformation journey continues, recording a 12% revenue improvement y-o-y in 4Q2024 despite weaker full year revenue compared to the same period last year, and a marginally positive operating EBIT in 4Q2024.

“We delivered a very strong set of results in 2024 despite an uncertain and challenging environment. We are confident that our strong fundamentals will continue to position us well, even as we confront a fast-changing landscape.

We have a robust order book and a competitive market position which will underpin our continuing revenue growth and performance.”

- Vincent Chong, Group President & CEO

In terms of Group revenue breakdown, Commercial Aerospace, Defence & Public Security and Urban Solutions & Satcom accounted for 39%, 44% and 17% respectively. Commercial sales was $7.8b and defence sales was $3.5b. The Group generated strong operating cash flow of $1.7b for the year ended 31 December 2024, a 46% increase y-o-y.

The Group decreased its unit operating expenses (per unit revenue) from 11.4% in 2023 to a low of 10.6% in 2024, a result of continual focus on cost management, productivity and enhancing operational efficiencies.

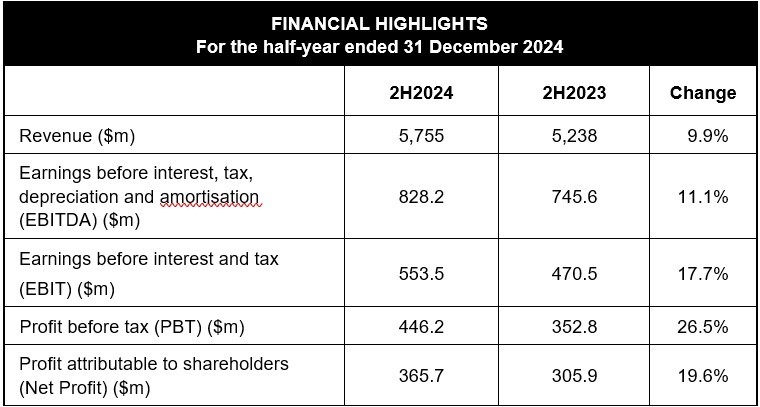

2H2024 versus 2H2023 Group Performance

In 2H2024, Group revenue grew 10% y-o-y to $5.76b from $5.24b. Group EBIT increased 18% to $554m from $470m. Group PBT was up 26% to $446m from $353m and Group Net Profit rose 20% y-o-y to $366m from $306m.

Revenue for the Commercial Aerospace segment was $2.15b, up 5% from $2.05b. Its EBIT grew 32% y-o-y to $210m from $160m. Defence & Public Security revenue was 20% higher at $2.56b from $2.13b. Its EBIT grew 17% y-o-y to $312m from $267m. Urban Solutions & Satcom revenue was flat at $1.04b, EBIT was $31m, compared to $44m in the prior year mainly due to margin mix.

New Contract Wins in 4Q2024 and Order Book

In 2024, the Group achieved $12.6b in new contract wins. Of this, about $4.3b worth of new contracts were secured in the fourth quarter. These comprised $1.8b from Commercial Aerospace segment, $1.7b from Defence & Public Security segment and $0.7b from Urban Solutions & Satcom segment.

With these new contract wins and adjustments for revenue delivery, ST Engineering ended 2024 with a robust order book of $28.5b. The Group expects to deliver about $8.8b from this order book in 2025.

Final and Total Dividend

The Board of Directors has proposed a final dividend of 5.0 cents per ordinary share, subject to shareholder approval at the upcoming AGM on 24 April 2025. When combined with the quarterly interim dividends of 12 cents per ordinary share for FY2024, the total dividend for FY2024 will be 17.0 cents per ordinary share, an increase from the 16.0 cents per ordinary share for FY2023. This translates to a dividend yield of 3.97%, computed using the average closing share price[2] of the last trading day of 2024 and 2023.

Notes:

[1] Refers to Group revenue by products and services type

[2] The average closing share price for FY2024 of $4.28 is computed based on closing share price of $3.89 for last trading day of 2023; and closing share price of $4.66 for last trading day of 2024.

*****

ST Engineering is a global technology, defence and engineering group with a diverse portfolio of businesses across the aerospace, smart city, defence and public security segments. The Group harnesses technology and innovation to solve real-world problems, enabling a more secure and sustainable world. Headquartered in Singapore, it has operations spanning Asia, Europe, the Middle East and the U.S., serving customers in more than 100 countries. ST Engineering reported a revenue of over $11 billion in 2024 and ranks among the largest companies listed on the Singapore Exchange. It is a component stock of MSCI Singapore, FTSE Straits Times Index and Dow Jones Best-in-Class Asia Pacific Index.

Follow us on LinkedIn.

For further enquiries, please contact:

Lina Poa

Head Investor Relations

ST Engineering

Email: ir@stengg.com

For media enquiries, please write to us at news@stengg.com

Subscribe to our newsletter

Copyright © 2025 ST Engineering

By subscribing to the mailing list, you confirm that you have read and agree with the Terms of Use and Personal Data Policy.