"ST Engineering did well in 2024. Each of our three segments — Commercial Aerospace, Defence & Public Security and Urban Solutions & Satcom — did its part. This was further augmented by continuous improvement, increasing productivity and strict cost discipline."

Teo Ming Kian, Chairman

Vincent Chong Sy Feng, Group President and CEO

Dear Shareholders,

ST Engineering did well in 2024. Each of our three segments — Commercial Aerospace, Defence & Public Security and Urban Solutions & Satcom — did its part. This was further augmented by continuous improvement, increasing productivity and strict cost discipline, thereby reducing the ratio of operating expenses over revenue.

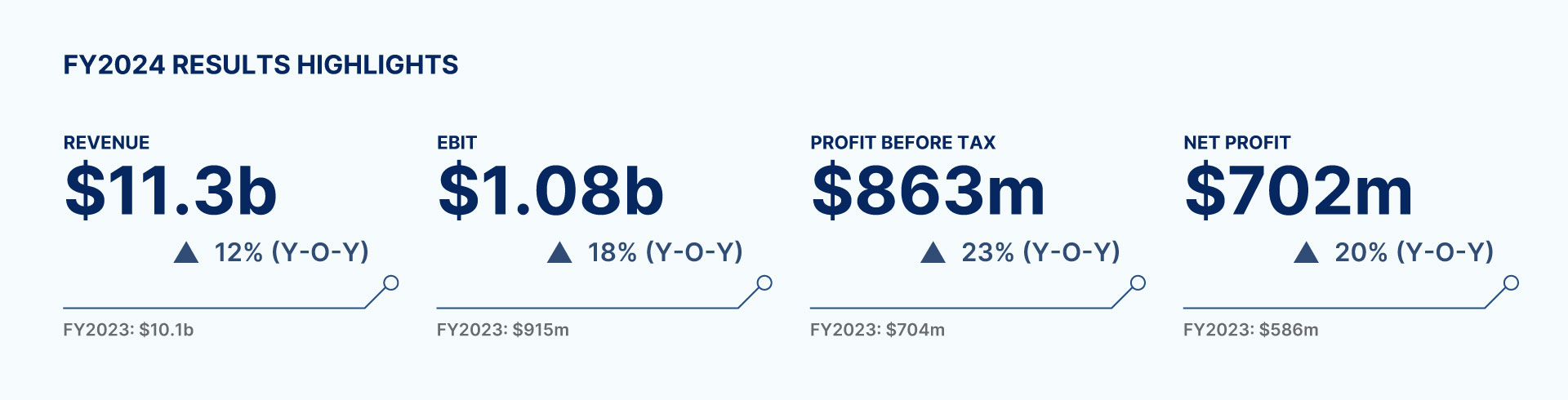

Group Net Profit increased 20% to reach a new high of $702m

The Group reported a 12% year-on-year (y-o-y) increase in revenue to $11.28b, Group EBIT reached $1.08b, marking a 18% y-o-y increase, while Group PBT rose by 23% y-o-y to $863m. Group Net Profit increased 20% to reach a new high of $702m. All three business segments contributed to the stronger y-o-y performance.

This strong set of results was achieved against a backdrop of geopolitical tension and a dynamic market landscape. This could be attributed to the breadth of our customer base and revenue streams across geographies, underscoring our global footprint and balanced portfolio in our diverse segments of Commercial Aerospace, Defence & Public Security and Urban Solutions & Satcom, strategically and painstakingly built up over the years.

The business segment details are covered in the Operating Review and Outlook section on Annual Report 2024 pages 26 to 43.

Over the past year, we have focused on navigating evolving global events, demonstrating the strength of our fundamentals and long-term strategy, as evidenced by $12.6b worth of new contracts that strengthened our order book to a new high of $28.5b. Our 2024 results further demonstrated our disciplined approach and effective execution of our order book.

A key focus of our Commercial Aerospace business is to address the changing dynamics of the aviation industry. Supply chain constraints have caused production bottlenecks for aircraft OEMs, delaying new aircraft deliveries. As a result, airlines are operating existing fleets for longer periods, driving demand for airframe and engine MRO services and keeping our hangars at near full capacity. While near-term shortages in passenger aircraft feedstock have impacted our Airbus Passenger-to-Freighter conversion (PTF) volume, we have effectively reallocated resources to capitalise on the stronger airframe MRO demand. At the same time, we are strengthening our capability as a Premier MRO provider for CFM LEAP engines as it continues to expand. To ensure continued competitiveness despite inflationary pressures, we continue to seek operational efficiencies, productivity improvements and cost management initiatives. By enhancing our capabilities and maintaining a strong focus on service quality, we aim to strengthen our competitive position in the market.

Another key focus has been the effects of ongoing geopolitical tensions on our defence business. We remain committed to a strategy anchored on sustainable growth, addressing evolving defence needs driven by technology advances. We are also strategic in selecting target markets and focusing on products where we have a clear advantage, such as ammunition, land and naval platforms. Recent successes such as our collaboration with Kazakhstan Paramount Engineering to establish in-country production in Kazakhstan for a new 8x8 amphibious armoured vehicle, and the NATO-standard 155mm ammunition contracts with new European customers affirm both the growing trust in our defence solutions and our competitive edge. In Singapore, our position as the strategic partner in the Singapore defence ecosystem demands that we consistently drive technological advancements and deliver cutting-edge solutions, along with steadfast local support. This commitment ensures superior reliability and responsiveness, reinforcing our role in the operational readiness of our nation’s security.

... we ensure that our R&D efforts are both synergistic and impactful, with tangible business outcomes

Our Smart City business, particularly Smart Mobility, is integral to our growth strategy. Strong expansion potential is evident through key rail contract wins across Asia and Australia. In addition, we are pushing boundaries in other transformative projects such as our smart water platform enhancing services for Aegea in Brazil and a contract to design and operate an advanced smart city platform for Lusail City in Qatar, marking the city’s bold step towards full smart city integration powered by our advanced AI and data-driven technologies. These successes fuel our growth, reinforce our position as a leader in smart city innovation and enable customers to optimise operations while addressing evolving urban challenges. Meanwhile, in the U.S., our TransCore business gains momentum in reinforcing its leadership in tolling technology and back-office solutions through new contract wins and successful project execution. TransCore is now well positioned for expansion into Asia, after securing its first tolling solution contract in Southeast Asia, a beginning of the manifested synergies we anticipated from its acquisition.

While our Smart City business continues its strong trajectory and expands its footprint, we also recognise the challenges in our Satcom business. We remain very focused on its turnaround and long-term success, acknowledging that every transformation inevitably comes with risks and hurdles. Early signs of improvements in the last quarter of 2024 are encouraging but work remains to be done. In the rapidly evolving satellite industry marked by disruptions from new entrants and opportunities from new constellations and technologies, we aim to benefit from our innovative technologies and proactive strategies to capture new revenue opportunities. Our investment in developing ‘Intuition’, the next-generation, cloud-native, software-defined ground system for multi-orbit environments is one such example.

As advanced technologies and AI reshape the business landscape, we prioritise synergy across our diverse domains and R&D investments. Through the Group Technology Office and Group Engineering Centre, we drive innovation, develop breakthrough solutions and streamline efforts across the Group, enabling our businesses to focus on core operations while avoiding duplication in developing common core technologies and engineering solutions.

We also develop reusable common modules, such as AI Video Analytics Suite and AI Analytics tools... to accelerate time to-market and reduce development costs

We invest in critical digital technologies, including AI, data analytics, robotics, cybersecurity and 5G connectivity, along with the application of Generative AI and quantum computing. We also develop reusable common modules, such as AI Video Analytics Suite and AI Analytics tools for knowledge mining and risk analysis. These foundational components are embedded in our solutions to accelerate time-to-market and reduce development costs.

By addressing shared challenges through strategic investment in digital technologies, we ensure that our R&D efforts are both synergistic and impactful, with tangible business outcomes. This approach delivers continual value across our aerospace, defence and smart city domains, strengthening our position as an innovation leader while empowering our customers to achieve new levels of security, efficiency and performance.

As we build on our strategic priorities, we are equally committed to our sustainability agenda. In line with our climate action commitment, we have updated our target to reduce Scope 1 and 2 greenhouse gas emissions by 50% by 2030, revising the base year from 2010 to 2015, being a more challenging target. We also keep abreast of evolving regulatory requirements in sustainability reporting, such as the 2023 European Union Corporate Sustainability Reporting Directive. By ensuring timely and transparent disclosures, we reinforce our dedication to accountability and sustainability.

For a detailed overview of our ESG initiatives, please refer to our Sustainability Report 2024.

In 2024, changes were made to our Board as part of our disciplined renewal process. In February, Neo Gim Huay was appointed to the Board and a member of the Risk and Sustainability Committee. In June, Philip Lee Sooi Chuen joined the Board and the Executive Resource and Compensation Committee, the Nominating Committee and the Strategy and Finance Committee. In August, Lien Siaou-Sze was appointed to the Board, subsequently joining the Audit Committee in November. During the year, several directors retired or stepped down from the Board, including Quek See Tiat, Lim Sim Seng and Lim Ah Doo. Each served for many years, making invaluable contributions to our boardroom discussions and strategy deliberations. We thank them for their dedication and commitment.

In January 2025, Song Su-Min assumed the role of Chairman of the Risk and Sustainability Committee, succeeding Kevin Kwok Khien who remains as a committee member.

These changes underscore our dedication to fostering a dynamic and effective Board that upholds robust governance and strategic oversight as we navigate future challenges and opportunities.

Our robust, forward-looking plan builds on growth momentum and core strengths while pursuing new opportunities

The Board of Directors has proposed a final dividend of 5 cents per ordinary share subject to shareholder approval at the upcoming AGM. Combined with the quarterly interim dividends of 12 cents per ordinary share, the total dividend for FY2024 will be increased to 17 cents per ordinary share from 16 cents per ordinary share in FY2023. This translates to a dividend yield of 3.97%1. |

|

Our commitment to delivering value to our shareholders is based on strong performance underpinned by a robust balance sheet, as reflected in our Aaa and AA+ ratings from Moody’s and S&P respectively. We maintain a forward-looking financial strategy, ensuring that fund allocation — whether for dividends, strategic investments to drive growth, or debt reduction to actively manage our balance sheet — is carefully calibrated to balance immediate returns with long-term value creation.

Building on this foundation, we unveiled our new five-year targets at our Investor Day 2025, finalised as this Letter went to print. These targets reflect the strengths of our fundamentals and the positive growth prospects of our Group.

We maintain a forward-looking financial strategy, ensuring that fund allocation... is carefully calibrated to balance immediate returns with long-term value creation

Our robust, forward-looking plan builds on growth momentum and core strengths while pursuing new opportunities. With a strong track record of disciplined execution, we remain committed to delivering good dividends and capturing growth, positioning us to thrive in a dynamic market and create lasting value for our shareholders.

While our strategies are well-founded, we remain mindful of external factors and the execution risks inherent in any growth plan. We will approach these challenges with resolve, focusing on adaptability and resilience to navigate uncertainties effectively while staying firmly aligned with our growth objectives.

As we continue our growth journey, we extend our heartfelt thanks to all our stakeholders, with special appreciation to our shareholders. Our employees remain the foundation of our success, with their dedication and hard work being instrumental in our pursuit of becoming a global technology, defence and engineering powerhouse.

1Computed using the average closing share price of the last trading days of 2024 and 2023.

28 February 2025

Copyright © 2025 ST Engineering

By subscribing to the mailing list, you confirm that you have read and agree with the Terms of Use and Personal Data Policy.