Over the last decade, there has been a growing awareness for the need of a global effort to combat climate change. A significant milestone is the Paris Agreement of 2016, where in a show of global commitment, 174 countries came together to sign an international treaty to set a global framework to combat climate change. Since then, we have seen the rise of governmental regulations to encourage sustainability, enterprises have become more active and vocal in Environmental Social Government (ESG) agenda and unsurprisingly, we see a growth in Sustainability VC funds, Start ups and Investment.

Looking at the maritime sector, we see similarly a strong impetus for change. The maritime transport industry produces 940M tonnes of CO2 annually and this number is looking to increase by 20% over the next few years. As of today, the maritime industry accounts for over 3% of global greenhouse gas emissions. The maritime transport industry has long been known as one of the most difficult industry to police and regulate due to the inherent nature of shipping where ships are constantly moving across multiple jurisdictions and is owned by international companies with operations and interests worldwide.

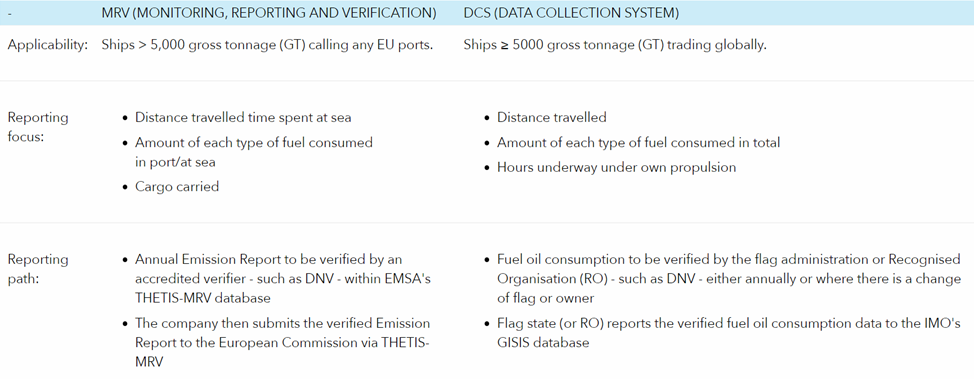

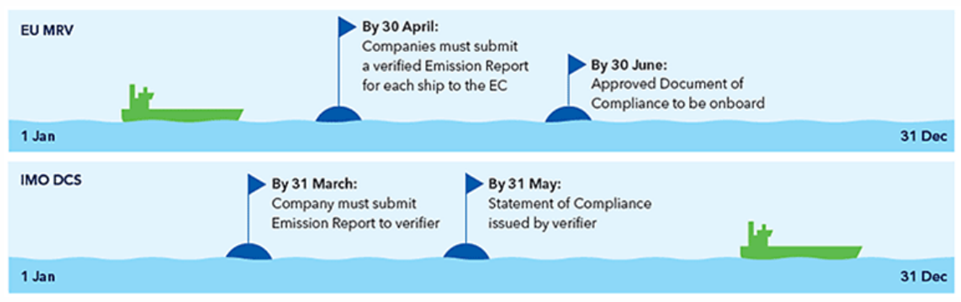

While projection sounds grim, currently, there are mandatory regulations in place by both the EU’s (European Union) Monitoring Reporting Verification (MRV) since 2017 as well as the IMO’s (International Maritime Organisation) Data Collection System (DCS) since 2018. To collect data as the first step to understanding the current situation and creating a harmonised platform that can be used towards the decarbonisation efforts of the maritime industry. A summary of the key facts on MRV and DCS can be found below[ii].

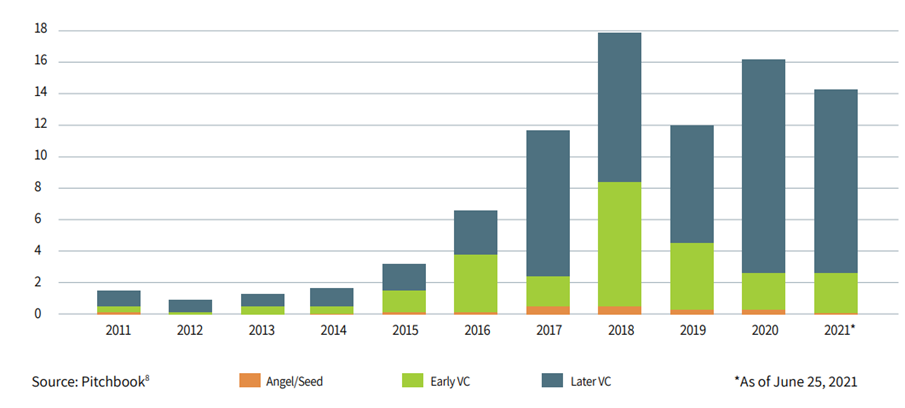

With both increasing awareness as well as regulation, we see an increase in the number of start ups that provide solutions in the space of Monitoring, Reporting, Verification (MRV) for the maritime industry. Going forward we will explore some of the key observations and trends for these startups.

Software based solutions vs Hardware based solutions

In order to provide the required information for the current regulations, ships must report either their calculated emissions or measured emissions. For calculated emissions, information such as fuel consumption, type of fuel, run/idle time of engines as well as a emission factor for different fuel types are required. For direct measurements, emissions are measured directly from exhaust stacks using sample probes, filters and gas analysers. Due to the differences in methodologies we see hardware based startups such as Everimpact from France, which brings IoT sensors for carbon emissions measurement as well as ChordX from Singapore, which is a software based solution that automates calculation and report generation.

Generally, we see more software-based solution in the market today as it can make use of current flow sensors in the fuel tanks or even through manual entry. Hardware solutions are less common potentially due to a technology development barrier and higher costs from implementation and hardware. Going forward the author believe it is likely for software based solutions to remain more popular due cost/ease of development and implementation. Unless there are further regulations to remove manual entry and improve the veracity of data collected, it is likely that hardware solutions will remain a smaller portion of the market in the near future.

Digitalisation of Maritime Industry

The maritime industry has traditionally been known as one that is conservative and slow to adopt new technologies and rightfully so. 40% of all technology companies in the maritime sector today have only been founded since 2011[iii] but slowly and surely the tide is turning and the shipping industry is turning towards technology as a solution towards increasingly tighter regulations and commercial margins.

Shipping as an industry benefit from increased connectivity to various information sources from ships location, environmental data, commodity prices, operational information etc. It is a dynamic environment where timely information can be key to optimal performance. Providing data visibility and insights are one of the key solutions provided by technology companies. As such, companies with the ability to provide MRV solutions also tend to provide other data-based insights and products ranging from predictive maintenance, route/fleet/revenue optimisation, market intelligence, emissions reduction etc. An example of some of these companies include US based Nautilus Labs, Vesselbot from Greece, Zero44 from Germany and Spinergie from France.

MRV is only the first step

While there is a rise in the amount of MRV solutions and products in the maritime world. It is important to remember that for both the EU and the IMO, monitoring and reporting is but the first step to provide visibility on the emissions data. The ultimate and eventual aim is still a sustainable shipping industry with reduced emissions.

Increasingly we will be seeing market-based measures such as carbon taxes/levies, green incentives, preferential green financing rates over the next couple of years. This is further compounded by the fact that shipping industry’s main customers (large corporates) will be further motivated to select greener transportation to improve their GHG Scope 3. What this means is that the industry will be motivated reduce carbon emissions and this will be where value is generated. In the long run, it is envisioned that MRV solutions while regulated will likely be commoditised with low margins while solutions/products that reduce emissions would be able to capture market and margins. Some examples include sustainable fuels, efficient engine designs, superior scrubber technologies, data insights for optimisation etc.

[iii] Source: Thetius-Inmarsat “The Optimal Route — the why and how of digital decarbonisation in Shipping”.

Copyright © 2025 ST Engineering

By subscribing to the mailing list, you confirm that you have read and agree with the Terms of Use and Personal Data Policy.