- Aerospace

-

Smart City

Smart Mobility (Rail)

Smart Mobility (Road)

-

- Marine

- Defence

- Public Security

- Digital Tech

-

Global

Risk Analysis

Climate-related Scenarios

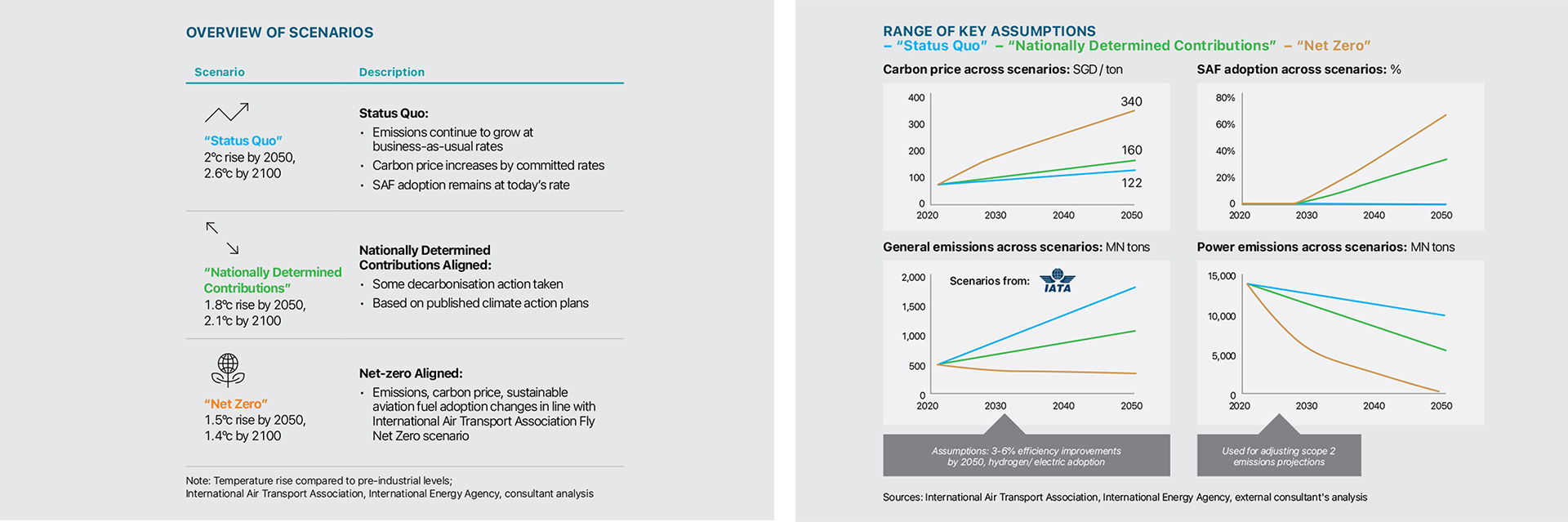

To assess the resilience of the Group's strategy, we accounted for different climate-related scenarios relevant to our business, including a 2°C or lower scenario. These scenarios help us to quantify the potential direct damages and operational risks to the Group's assets and key suppliers, with a specific focus on commercial aerospace.

[Click on image for larger view]

- We modelled the climate impact on assets utilising the Representative Concentration Pathway 8.5 scenario taken from the Intergovernmental Panel on Climate Change (IPCC) with a timeline of up to 2100.

- We also referred to Nationally Determined Contributions (NDC) scenarios and utilised sector specific decarbonisation scenarios including International Air Transport Fly Net Zero for Aviation for transition risks up to 2050.

- For our our other businesses, we conducted an initial high level analysis based on general decarbonisation scenarios, such as the International Energy Agency (IEA) Net Zero Emissions by 2050 scenario and the IEA Sustainable Development Scenario.

Climate Risks

We recognise that climate change poses different types of risks to our business. These include physical risks, such as flooding, extreme weather events and increasing temperatures, which can disrupt or negatively impact our employees, assets and supply chains. We also acknowledge the potential financial impacts that can result from transition risks, which include regulatory, market and reputational risks.

Physical Risks

In the short and medium term, the physical risk to our productive assets and our people is low. We have put in place a process to regularly review facilities against extreme climate and weather events.

Transition Risks

We expect minimal impact on our business in the transition to a low carbon economy in the short and medium term.

We will continue to monitor emerging topics including the evolving regulatory and carbon tax environment, cognisant of the following watchpoints:

|

|

Carbon tax and costs are likely to be passed to the Group through suppliers, for goods and services with embodied carbon. Accordingly, the carbon price and sector specific regulations is a crucial space to monitor. |

|

|

Shifts in demand and innovation calls within our industries will need increased attention and action. These include tracking sectoral structural shifts such as competitors’ efforts to launch greener products, and investing into climate-related business and technology opportunities. |

|

|

The impact on our supply chain from climate change needs to be examined in more detail. This is an addition to the challenges caused by increased regulatory requirements and other macro trends, such as geopolitical tensions, elevated inflation rates and energy cost. We have established a supply chain resiliency framework and have engaged our key suppliers on a range of ESG topics including those related to climate change. |